Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 03:51 PM | Permalink | Comments (0)

We are living through the fastest period of technological change in history — a fact that demands not just awareness, but active engagement. Here’s how to recognize this shift, and what you can do to succeed in it.

Our ancestors survived by thinking locally and linearly. Yet today, this mindset often leaves us struggling to anticipate the sweeping, unpredictable effects of technology.

To predict the future of technology, you must understand where we are and where we are headed ... but it also helps to recognize how far we’ve come—and how quickly things are now accelerating.

Our World In Data put together a great chart that shows the entire history of humanity in relation to innovation. It shows how fast we are moving by telling the story with milestones.

Innovation isn’t only driven by scientists. It’s driven by people like you or me having a vision and making it into a reality.

To see just how far we’ve come — and how quickly things now change — let’s look at some milestones.

3.4 million years ago, our ancestors supposedly started using tools. 2.4 million years later, they harnessed fire. Forty-three thousand years ago (almost a million years later), we developed the first instrument, a flute.

The innovations we just discussed happened over an astonishing expanse of time. Compare that to this: In 1903, the Wright Brothers first took flight ... and just 66 years later, we were on the moon. That’s less than a blink in the history of humankind, and yet our knowledge, technologies, and capabilities are expanding exponentially.

Technology was like a snowball gathering speed, but it’s become an avalanche—hurtling forward, accelerated by AI. Here are some fun facts to back that up.

ChatGPT’s Explosive Growth: In 2025, OpenAI’s ChatGPT will hit 700 million weekly active users—a fourfold increase over the previous year. In its first year, ChatGPT reached 100 million monthly active users in just two months, a milestone that took Instagram 2.5 years.

Workforce Shift: About 97 million people will work in the AI sector by the end of 2025, and the value of the U.S. AI sector already exceeds $74 billion.

Usage Surge: As of July 2025, users submit 2.5 billion prompts to ChatGPT every day, and analysts expect OpenAI to reach 1 billion users by the end of the year.

Yesterday’s stable footing guarantees nothing; you must constantly adjust or get swept away.

While AI dominates headlines, the same story of acceleration is unfolding in fields like biotechnology, climate tech, and robotics. It’s happening everywhere all at once. From nanotechnologies to longevity and age reversal, and from construction to space exploration ... exponential change is becoming a constant.

Though I lead an AI company, I’m not an engineer or a data scientist — I am a strategist. My role is to envision bigger futures, communicate them clearly, and leverage tools that free me to create greater value. Ultimately, that’s going to become everybody’s job.

I don’t believe that AI will replace people like us quickly, but common sense tells us that people who use AI more effectively might replace us faster than we’d like.

Start by experimenting with new AI tools. When was the last time you tried a new tool or technology? Even though our company works on AI every day, I’ve challenged myself to continually expand my ability to use AI to create the things I want.

You’ll probably find that the things you want most are just outside your current comfort zone — or you’d already have them.

The next level of impact and value lies just beyond your current habits—comfort is the enemy of reinvention.

A good start is to think about what routine task you could automate next week.

Leaders must move from certainty-seeking to rapid experimentation. Encourage nimble, high-frequency experimentation with emerging tech.

Focus on skillsets that complement, not compete with, automation. And vice versa, focus on automation that complements (rather than competes with) unique abilities.

Share your learnings with your team or community. Set the expectation of progress, and make regular sharing and reporting part of your process. Reward the sharing of learnings over the accumulation of dead knowledge.

Prepare teams not only technologically, but culturally and psychologically, for relentless reinvention.

Brene Brown, a noted leadership expert, says, “Vulnerability is the birthplace of innovation, creativity, and change.”

Don’t let perfectionism hold you back. You don’t need to know every destination before boarding the train; what matters is that you get on. Waiting too long is no longer safe—the train is leaving, and the cost of inaction is climbing.

Success now means hopping on and adapting while in motion—not waiting for all the answers.

Onwards!

Posted at 08:19 PM in Business, Current Affairs, Gadgets, Healthy Lifestyle, Ideas, Market Commentary, Personal Development, Science, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

New technologies fascinate me ... As we approach the Singularity, I guess that is becoming human nature.

Ray Kurzweil (who is a well-respected futurist, inventor, and entrepreneur) optimistically predicts accelerating returns and exponential progress, where the technological advancements experienced in the 21st century will be vastly more significant and disruptive than those in previous centuries. Kurzeil believes: “The next century won’t feel like 100 years of progress—it will feel like 20,000."

However, there is a tension between our ability to imagine grand futures and our struggle to execute the how—the messy, uncertain work of getting there.

Nassim Nicholas Taleb (a noted expert on randomness, probability, complexity, and uncertainty) reminds us that, “We often overestimate what we know and underestimate uncertainty.” There is a risk that “continuous forward motion” sometimes leads to dead ends and that speed without thoughtful direction can be dangerous. This is true in part because technology adoption is often more about human nature than the absolute value of technology.

This post is about embracing the paradox of accepting both the value of vision and the discipline of small, progressive steps.

Dreaming vs. Doing

Recognize that the future is co-authored by dreamers and doers.

To get us started, here is a video, put together by Second Thought, that looks at various predictions from the early 1900s. It is a fun watch – Check it out.

via Second Thought

The Fascination With and Challenges of Prediction

It’s interesting to look at what they strategically got right compared to what was tactically different.

In a 1966 interview, Marshall McLuhan discussed the future of information with ideas that now resonate with AI technologies. He envisioned personalized information, where people request specific knowledge and receive tailored content. This concept has become a reality through AI-powered chatbots like ChatGPT, which can provide customized information based on user inputs.

Although McLuhan was against innovation, he recognized the need to understand emerging trends to maintain control and know when to “turn off the button.”

In 1966, media futurist Marshall McLuhan envisioned a form of digital research eerily similar to the customized queries now answered by AI. Then he makes a surprising admission about why he studies technological change—with a lesson I think many need to hear. pic.twitter.com/yEBJv95GvP

— Benjamin Carlson (@bfcarlson) March 22, 2023

Prophecy vs. Navigation

While we revere “prophetic” moments, most successful outcomes arise from continuous adjustment—not perfect foresight.

Peter Drucker famously said, “The best way to predict the future is to create it.”

I’ll say it a different way ... It’s more useful to view innovation as navigation, rather than prophecy.

Like evolution, Success isn’t about strength or certainty—it’s about the ability to adapt quickly and course-correct as conditions change. This mindset urges leaders to embrace agile, resilient strategies that can respond rapidly to emerging opportunities and threats.

With that said, activity is not progress if it doesn’t lead you in the right direction. There are times when continuous course-correction can lead a team in circles. Pausing for periodic reflection and creating feedback loops helps prevent innovation drift.

While not all predictions are made equal, we seem to have a better idea of what we want than how to accomplish it.

The farther the horizon, the more guesswork is involved. Compared to the prior video on predictions from the mid-1900s, this video on the internet from 1995 seems downright prophetic.

via YouTube

The Distinction Between Envisioning Outcomes and Creating Practical Paths to Them.

There’s a lesson there. It’s hard to predict the future, but that doesn’t mean you can’t skate to where the puck is moving. Future success goes to those who can quickly sense shifts, reorient, make decisions, and take action.

Even if the path ahead is unsure, it’s relatively easy to pick your next step, and then the next step. As long as you are moving in the right direction and keep taking steps without stopping, the result is inevitable.

In Uncharted Territory, It’s Better to Use a Compass Than a Map

The distant future may be fuzzy, but it’s our willingness to keep moving—and keep learning—that tips the odds in our favor.

Reflect on the value of looking ahead, not for certainty but for direction.

Don’t worry if you can’t see your intended destination. Just focus on your next step and trust the journey.

Remember, there is always a best next step.

Onwards!

Posted at 11:00 PM in Business, Current Affairs, Gadgets, Ideas, Market Commentary, Personal Development, Science, Trading, Web/Tech | Permalink | Comments (0)

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 10:54 PM | Permalink | Comments (0)

The World seems very “Us” versus “Them”... But are we really that different?

The six largest religions in the world are Christianity, Islam, Judaism, Hinduism, Buddhism, and Sikhism.

If you stripped away doctrine, what patterns might emerge in the world’s great sacred texts?

Similarity in Diversity.

We often think about the differences between religions. However, a deep review of their sacred texts shows striking similarities (and may be indications of a more integral “truth”).

Below is a word cloud for each of those religions based on their primary religious text. A word cloud is a visual map of language where the size and boldness of a word reflect its frequency in the text. In this case, the image spotlights the most frequent words across different religious texts (e.g., Jewish Bible, Christian New Testament, Quran, Hindu Vedas, Buddhist Tripitaka, Sikh Guru Granth Sahib).

Each panel highlights high-frequency terms like Lord, God, man, people, Israel, Indra, Agni, Allah, fortunate, Guru, etc., with the most frequently used words appearing larger and bolder. A visualization, like this, makes it easy to identify the recurring themes or focal points of each tradition.

So, here is a closer look at what a word cloud of the world’s religions reveals if we strip away doctrine and focus only on frequency.

teddyterminal via Reddit

On one level, this post explores both the similarities and limits of religious texts via word clouds.

As historian Yuval Harari notes, “Humans think in terms of stories, not statistics.” Those word clouds are the beginnings of narratives that go beyond the numbers. For example, shared words don’t mean shared values. The word ‘love’ in one tradition may imply obedience, while in another it means self-transcendence.

The Power and Pitfalls of Translation

Likewise, translating sacred texts into English makes them more accessible, but can distort meaning and nuance. As an illustration, if you noticed the name “Keith” at the bottom of the Hinduism word cloud, it’s because that was the translator’s name. You might also have seen the word “car” in the Hinduism cloud, that is not an anachronism or prophecy... it is just another old-fashioned word for “chariot”.

It’s also worth acknowledging that this word cloud is from the English translations, so some words that may mean slightly different things in other languages can be all translated to one word in English. For example, it’s very common in Biblical Hebrew to see different words translated into the same English word. Examples include Khata, Avon, and Pesha – three different “ways of committing a wrong” that may all be translated to the same English word.

Distortions like these occur across many texts and cultures. In other words, similarities in word usage do not always reflect shared values. Recognizing this helps us navigate between the boundaries of certainty and uncertainty.

This brings to mind an ancient parable …

The Parable of Perspectives – Lessons from the Elephant

I’ve always loved the parable of the blind men and the elephant. While there are many versions, here’s broadly how it goes:

A group of blind men heard that a strange animal, called an elephant, had been brought to the town, but none of them were aware of its shape and form. Out of curiosity, they said: "We must inspect and know it by touch, of which we are capable". So, they sought it out, and when they found it they groped about it. The first person, whose hand landed on the trunk, said, "This being is like a thick snake". For another one whose hand reached its ear, it seemed like a kind of fan. As for another person, whose hand was upon its leg, said, the elephant is a pillar like a tree-trunk. The blind man who placed his hand upon its side said the elephant, "is a wall". Another who felt its tail, described it as a rope. The last felt its tusk, stating the elephant is that which is hard, smooth and like a spear.

This parable highlights that even when everyone is “blind” to the whole truth, each perspective still holds real insight. Recognizing that partial views are still valuable can drive innovative, integrative thinking.

The blind men and the elephant parable also reminds us of the limitations of individual perspectives and the value of integrating multiple viewpoints. Interestingly, that integration is one of the things large language models are best at ... and helping humans access a perspective of perspectives might be a step towards enlightenment.

Future societies may see it as obvious that synthesizing perspectives (religious, cultural, strategic) can be done by advanced AI at scale, transforming how we resolve complex disputes.

Hope that helps.

Oh, and as a thought experiment ... What would the word cloud of your own guiding beliefs look like?

Posted at 05:18 PM in Art, Books, Business, Current Affairs, Gadgets, Ideas, Just for Fun, Personal Development, Religion, Science, Trading Tools, Web/Tech | Permalink | Comments (0)

I have a poster hanging in my office that says: “Artificial Intelligence is cool ... Artificial Stupidity is scary.”

The point is that we like the idea of automation and real-time decision-making, but only if the answers are correct.

Speed amplifies truth and error. AI makes you smarter faster—or wrong at scale. Sometimes, the systems we build to make better decisions also multiply our mistakes. Several core tensions create that paradox.

The problem isn’t just with automation. I’ve come to understand that an answer is not always THE answer. Consequently, part of a robust decision-making process is to figure out different ways of coming up with an answer ... and then figuring out which of those serves your purposes best.

That distinction is essential in automation and designing agentic processes, but it’s also important to think about that as we operate on a day-to-day basis.

That’s the point of today’s post. It’s about some of the common logical errors that prevent us from getting better results.

Several times this week, I used a simple framework that says if the outcome isn’t right, start by looking at the people, the process, and the information. Meaning, when troubleshooting outcomes, investigate whether you are using the right resource, the best method, and whether you have enough complete and accurate information to make an informed decision.

With that in mind, here is a quick primer on logical fallacies.

A logical fallacy is a flaw in reasoning. In other words, logical fallacies are like tricks or illusions of thought. As you might suspect, politicians and the media often rely on them. Recently, we discussed the Dunning-Kruger Effect ... but that’s just the tip of the iceberg.

Oxford Learning via InFact with Brian Dunning (Part 2, Part 3)

It is fun to identify which of these certain people (including yourself) use when arguing, deciding, or otherwise pontificating. To help, here is a short list of TWENTY LOGICAL FALLACIES:

They fall into three main types: Distraction (10), Ambiguity (5), and Form (5).

A. Fallacies of Distraction

1. Ad baculum (Veiled threat): "to the stick":

DEF.- threatening an opponent if they don’t agree with you; EX.- "If you don’t agree with me you’ll get hurt!"

2. Ad hominem (Name-calling; Poisoning the well): "to the man":

DEF.- attacking a person’s habits, personality, morality or character; EX.- "His argument must be false because he swears and has bad breath."

3. Ad ignorantium (Appeal to ignorance):

DEF.- arguing that if something hasn’t been proved false, then it must be true; EX.- "U.F.Os must exist, because no one can prove that they don’t."

4. Ad populum: "To the people; To the masses":

DEF.- appealing to emotions and/or prejudices; EX.- "Everyone else thinks so, so it must be true."

5. Bulverism: (C.S. Lewis’ imaginary character, Ezekiel Bulver)

DEF.- attacking a person’s identity/race/gender/religion; EX.- "You think that because you’re a (man/woman/Black/White/Catholic/Baptist, etc.)"

6. Chronological Snobbery

DEF.- appealing to the age of something as proof of its truth or validity; EX.-"Voodoo magic must work because it’s such an old practice;" "Super-Glue must be a good product because it’s so new."

7. Ipse dixit: "He said it himself":

DEF.- appealing to an illegitimate authority; EX.- "It must be true, because (so and so) said so."

8. Red Herring (Changing the subject):

DEF.- diverting attention; changing the subject to avoid the point of the argument; EX.- "I can’t be guilty of cheating. Look how many people like me!"

9. Straw Man:

DEF.- setting up a false image of the opponent's argument; exaggerating or simplifying the argument and refuting that weakened form of the argument; EX.- "Einstein's theory must be false! It makes everything relative--even truth!"

10. Tu quoque: "You also"

DEF.- defending yourself by attacking the opponent; EX.- "Who are you to condemn me! You do it too!"

B. Fallacies of Ambiguity

1. Accent:

DEF.- confusing the argument by changing the emphasis in the sentence; EX.- "YOU shouldn’t steal" (but it’s okay if SOMEONE ELSE does); "You shouldn’t STEAL" (but it’s okay to LIE once in a while); "You SHOULDN’T steal (but sometimes you HAVE TO) ."

2. Amphiboly: [Greek: "to throw both ways"]

DEF.- confusing an argument by the grammar of the sentence; EX.- "Croesus, you will destroy a great kingdom!" (your own!)

3. Composition:

DEF.- assuming that what is true of the parts must be true of the whole; EX.- "Chlorine is a poison; sodium is a poison; so NaCl must be a poison too;" "Micro-evolution is true [change within species]; so macro-evolution must be true too [change between species]."

4. Division:

DEF.- assuming that what is true of whole must be true of the parts; EX.- "The Lakers are a great team, so every player must be great too."

5. Equivocation:

DEF.- confusing the argument by using words with more than one definition; EX.- "You are really hot on the computer, so you’d better go cool off."

C. Fallacies of Form

1. Apriorism (Hasty generalization):

DEF.- leaping from one experience to a general conclusion; EX.- "Willy was rude to me. Boys are so mean!"

2. Complex question (Loaded question):

DEF.- framing the question so as to force a single answer; EX.- "Have you stopped beating your wife yet?"

3. Either/or (False dilemma):

DEF.- limiting the possible answers to only two; oversimplification; EX.- "If you think that, you must be either stupid or half-asleep."

4. Petitio principii (Begging the question; Circular reasoning):

DEF.- assuming what must be proven; EX.- "Rock music is better than classical music because classical music is not as good."

5. Post hoc ergo propter hoc (False cause): "after this, therefore because of this;"

DEF.- assuming that a temporal sequence proves a causal relationship; EX.- "I saw a great movie before my test; that must be why I did so well."

For more on that, here is a fun and informative infographic by The School of Thought.

We must use logic as a spam filter: Fallacies are the junk mail of thought—fast, flashy, and costly when clicked.

Hope that helps.

Posted at 10:39 PM in Business, Current Affairs, Ideas, Just for Fun, Personal Development, Religion, Science, Trading, Writing | Permalink | Comments (0)

Here are some of the posts that caught my eye recently. Hope you find something interesting.

Lighter Links:

Trading Links:

Posted at 10:19 PM | Permalink | Comments (0)

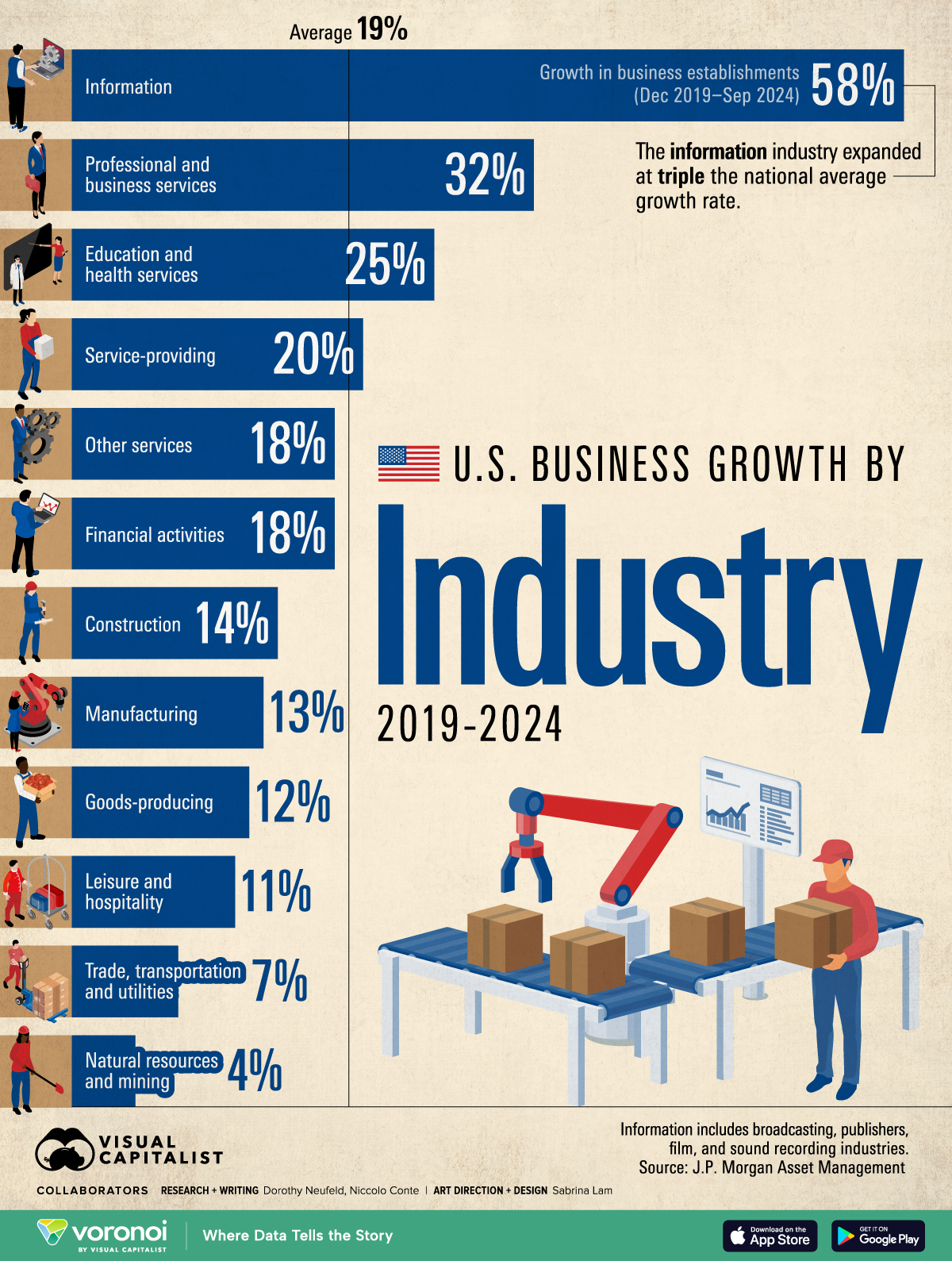

via visualcapitalist

via visualcapitalist

Business creation has grown almost 20% over the last five years, with small businesses generating about 60% of new jobs in America. However, a look at the data shows a small number of firms drive most of that growth.

According to J.P. Morgan, the information sector posted the strongest five‑year growth gains (+58%), followed by professional and business services (+32%) and education and health services (+25%).

It’s not surprising that the information business grew fastest, given the catalyst that AI and automation offer, and the growing awareness that data is increasingly a valuable asset.

AI today reminds me a lot of the Internet boom in the early 2000s. Back then, everyone focused on the technology, and it seemed like a separate tech domain. But now, almost every company relies on that technology as infrastructure, making it part of the playing field. I believe AI will become so widespread that, for most businesses, it will simply be part of the landscape.

For example, AI and healthcare are a natural pair with transformative potential. By making diagnostic procedures faster, predicting patient outcomes, and customizing treatment plans, AI is poised to revolutionize how we treat or cure diseases and also how we improve longevity and regenerative medicine results. Interest and assets are sure to flow into that sector.

However, no matter where you look, the growing capabilities and tech infrastructure have profound implications for growth and transformation.

I’m curious which sectors you expect to grow fastest going forward?

As always ... Onwards!

Posted at 02:48 PM in Business, Current Affairs, Ideas, Market Commentary, Science, Trading, Web/Tech | Permalink | Comments (0)

I don’t usually write about individual companies, but an infographic highlighting BlackRock’s impressive growth caught my eye.

BlackRock has been around since 1988. It wasn’t until the early 2000s that it really took off, but since then, they’ve clearly been doing something right.

Now, they are the world’s largest asset manager.

Voronoi via visualcapitalist

In 2006, BlackRock acquired Merrill Lynch Investment Managers, nearly doubling its AUM, but its CAGR shows that it’s not just luck that has helped BlackRock achieve its current position.

In 2023, when I reviewed their equity holdings, they held approximately $9 trillion in assets. Now that has grown to more than $12 trillion.

While they aren’t as transparent as Berkshire Hathaway about what they do or how they do it, according to its website, BlackRock positions itself as a systematic investor that leverages vast datasets and new technologies.

Comparing again to Berkshire Hathaway, both have invested heavily in Apple, which isn’t particularly surprising.

While I enjoy insights into other investors' playbooks, it’s not the be-all and end-all. It’s simply one way to invest ... and might be a reasonable way to get from a lot of money to even more money - but their trading strategy isn’t necessarily going to work for the average investor (or you).

Still, when there is blood in the streets … asking, “What would Warren or Blackrock do?” might be a great place to start.

However, it is challenging to maintain an edge if you use the same process and data as your competitors (especially when they have enough assets to use time or trade size to their advantage).

As the flywheels of commerce spin faster, edges will emerge and decay faster than ever before. Finding a solution is only a step in an ongoing process.

Robust, reliable, and repeatable innovation at scale is a meaningful competitive advantage. That implies that idea factories will become as important (if not more so) than factories that produce material products. Likewise, innovation funnels will become more important than sales funnels.

The world changes at the speed of thought ... and as technology continues to improve ... even faster.

Thankfully, we live in interesting times.

Posted at 07:38 PM in Business, Current Affairs, Ideas, Market Commentary, Trading, Trading Tools, Web/Tech | Permalink | Comments (0)

Foreign Direct Investments

Against a backdrop of economic uncertainty, supply chain upheaval, and rapid technological transformation, foreign direct investment remains a bellwether of global confidence and strategic priorities.

Looking back to 2024, the patterns of FDI offer a window into what the world’s investors value most—and what new risks and opportunities are on the horizon.

In a rapidly shifting global landscape, investors are constantly on the hunt for both opportunity and resilience. Which sectors and regions captured the lion’s share of foreign direct investment in 2024—and what fueled these evolving priorities?

The Global State of FDI in 2024

Visual Capitalist created an infographic that shows Foreign Investors allocated more than $1 trillion across the top 10 global sectors in 2024, highlighting the scope and realignment of worldwide capital movements.

via visualcapitalist

Sector Standouts: Winners and Surprises

Now let’s zoom into specific industries.

Renewable energy topped the list, drawing $270.1 billion in FDI. Even so, renewable energy FDI declined — mainly due to rising material costs, tougher regulations, and delayed projects. Despite these setbacks, long-term prospects in renewables are robust.

Perhaps the most surprising winner of 2024, the communications sector not only rebounded but grew by an astonishing 84%, far outpacing previous years. This likely reflects accelerated 5G rollouts and infrastructure expansions in both developed and emerging markets.

Semiconductors followed closely, likely reflecting the growing infrastructure requirements of global reliance on AI.

Notably, FDI in real estate increased despite a critical labor shortage, sparking questions about how investment is responding to workforce constraints.

Meanwhile, traditional manufacturing showed minimal growth, as investors appear wary of ongoing supply chain disruptions and increasing automation across the industry.

Regional Focus: Asia’s Rise & India’s Transformation

Regionally, the FDI tide was far from even. Asia emerged as the dominant destination for FDI. While India, alone, attracted investment across more than 1,000 distinct projects, driven by robust economic reforms and a burgeoning market.

What’s Next?

FDI patterns are not static reflections but dynamic forecasts of the next big global moves. Consequently, geopolitics and regulatory shifts impact FDI as well.

As global investment patterns continue to evolve, the next wave of foreign direct investment will likely redefine which strategies (and which regions) lead. Will emerging trends hold, or will new surprises shift the map again next year?”

Where would you bet global capital will go next?

Posted at 04:16 PM in Business, Current Affairs, Ideas, Market Commentary, Science, Trading, Trading Tools, Travel, Web/Tech | Permalink | Comments (0)

Reblog (0)